tax credit survey social security number

Read our full guide on W9s and online survey taking if youd like to learn more. Once you are issued an SSN use it when paying your estimated taxes.

Employer Tax Credits For Paid Family And Medical Leave

Get a replacement Medicare card.

. However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. Well as long as its reputable company yes it should be fine. The Social Security Number Verification Service - This free online service allows registered users to verify that the.

If the filing deadline is approaching and you. Is there a reason why they need our social security numbers. The form will ask you for your personally identifiable information full name address etc as well as your SSN.

If you have applied for and are currently waiting to receive the childs new SSN you may either. Its asking for social security numbers and all. My mom wont give me my social security number because she doesnt trust the site.

Social security number SSN required for child tax credit. Filing deadline approaching and still no Social Security Number. Start or change direct deposit of your benefit payment.

Do you have to fill out Work Opportunity Tax Credit program by ADP. I dont feel safe to provide any of those information when Im just an applicant from US. If you or your spouse dont have an Social Security Number you can apply for one by filing Form SS-5 with the SSA.

If your dependent child has an ITIN but not an S. Its a short form and probably wont take more than a minute or two to fill out. The first is to file your taxes as early as possible and the second is to let the IRS know that your Social Security number was stolen.

Most controversial is the practice of employers asking for social security numbers from every applicant whether the individual will receive further consideration or not. Your child must have an SSN issued before the due date of your 2018 return including extensions to be claimed as a qualifying child for the child tax credit or additional child tax credit. Asking for the social security number on an application is legal in most states but it is an extremely bad practice.

Change your address and phone number. Unfortunately for you a Social Security Number is required for the 2000 Child Tax Credit not just the refundable portion. Some states prohibit private employers from collecting.

So I guess I made a bad first impression on the phone. You have every right to be protective of your SSN though. Its asking for social security numbers and all.

Get your Social Security Statement to review. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Your health insurance company is required to provide Form 1095-B PDF Health Coverage to you and to the Internal Revenue.

Social Security offers three options to verify Social Security numbers. Check your benefit and payment information and your earnings record. TaxAct requests a valid Social Security Number SSN be entered in order for certain credits and deductions to calculate ie.

A taxpayer should continue to use their social security number to pay their estimated taxes once it has been issued even if it is not valid for employment or no longer valid for employment. This is strictly for tax purposes only and is the only time when it is acceptable to provide a research company with your social security number. Electronically file the return without the dependent and then file an amended return after receiving the ID number or.

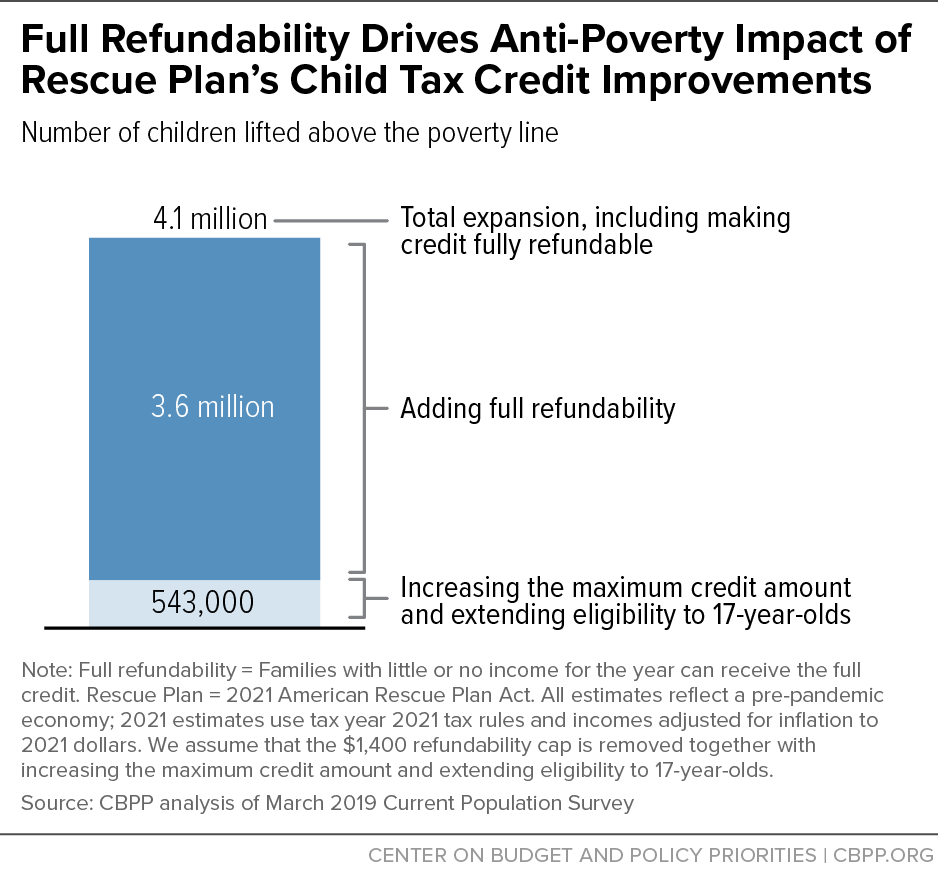

Youll want to fill out and file Form 14039. However you will still be potentially eligible for the 500 non-refundable credit that is for other dependents. Forbes cites a survey of parents from the week before the first round of the expanded Child Tax Credit began in July which found that only 75 of immigrant parents were aware of the credit.

Employers organizations or third-party submitters can verify Social Security numbers for wage reporting purposes only. The answers are not supposed to give preference to applicants. Verifying Social Security Numbers.

But we only b ask our employees to fill out the survey not applicants. Madhatters4 9K opinions shared on Other topic. Get a replacement SSA-1099 or SSA-1042S for tax season.

So if it doesnt work out next time I know. Child tax credit other dependent credit etc. My health insurance company has requested that I provide them with my social security number and the social security numbers of my spouse and children.

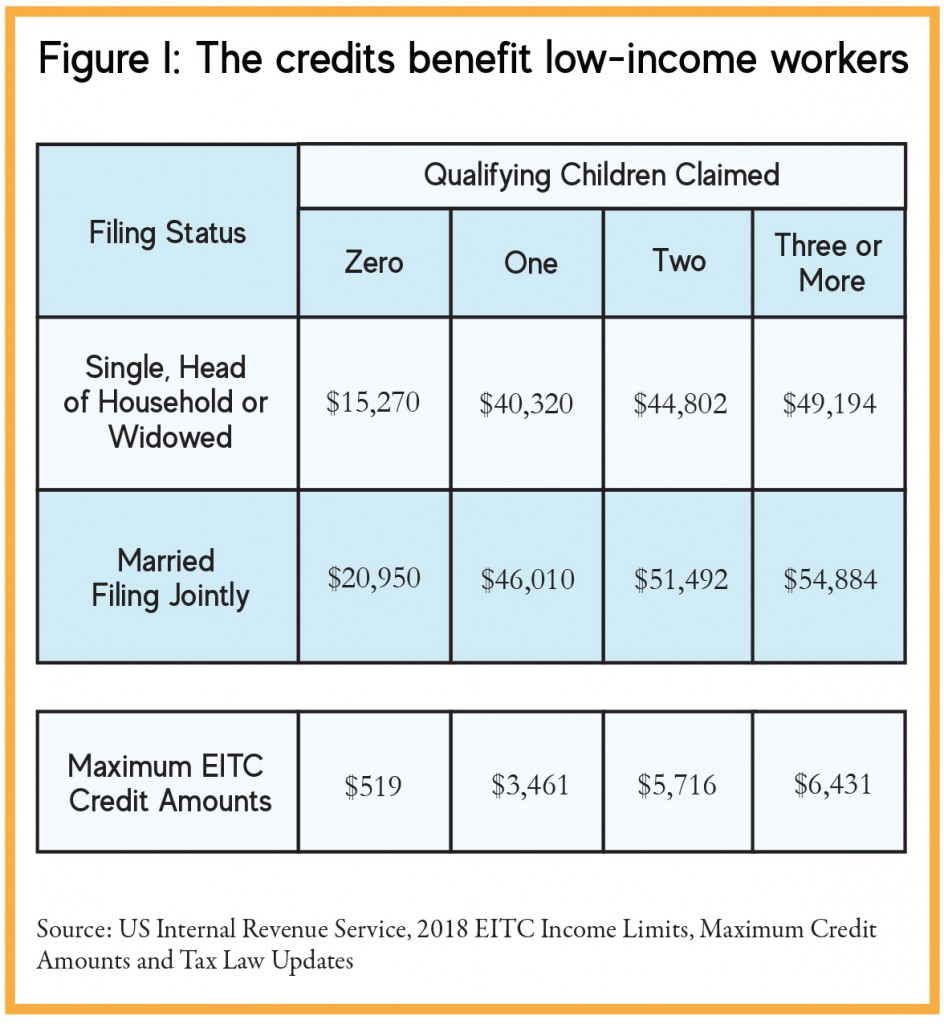

If you do not receive benefits you can. For more information about the Social Security number rules for the EITC see Rule 2 in Publication 596 Earned Income Credit. Rule 2You Must Have a Valid Social Security Number SSN To claim the EIC you and your spouse if filing a joint return must have a valid SSN issued by the Social Security Administration SSA by the due date of.

I dont feel safe to provide any of those information when I. You can get Form SS-5 online click here from your local SSA office or by calling the SSA at 1-800-772-1213. The owners of the site is Walton management services and it says our company is participating in a federal jobs tax credit program called the work opportunity tax credit program.

These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

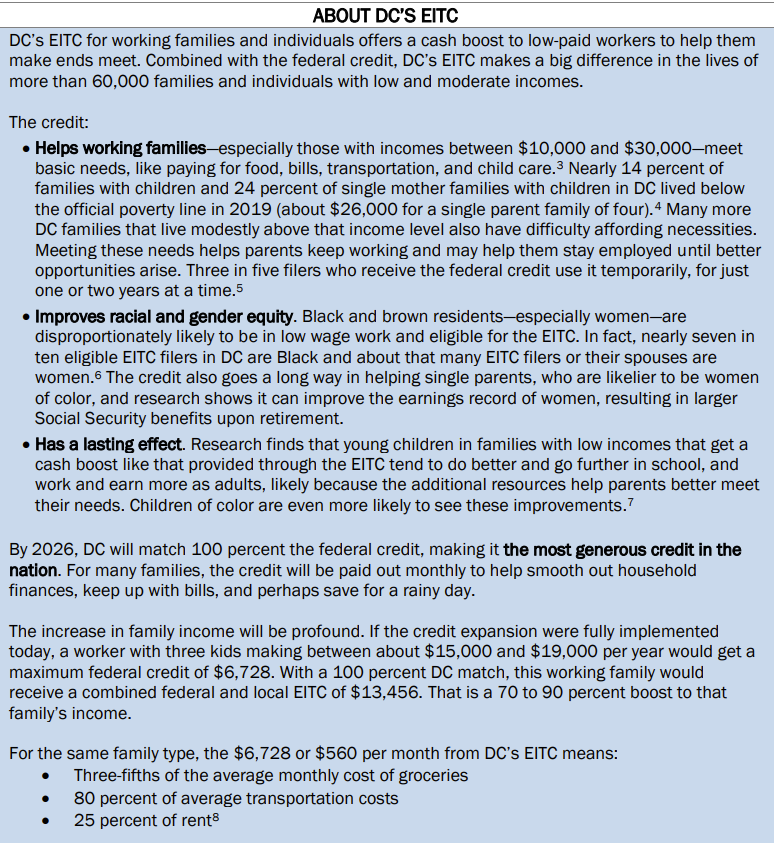

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Asking For Social Security Numbers On Job Applications Goodhire

What Is A Tax Credit Screening When Applying For A Job Welp Magazine

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Pin On Things That Should Make You Go Hmmm

House Bill Takes Major Steps Forward For Children Low Paid Workers Center On Budget And Policy Priorities

Irs Releases Instructions For Forms W 2 And W 2c Reporting Of Employee Deferral And Repayment Of Social Security Taxes Under Irs Notice 2020 65

Work Opportunity Tax Credit What Is Wotc Adp

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

New Mexico S Working Families Tax Credit And The Federal Earned Income Tax Credit New Mexico Voices For Children

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit Department Of Labor Employment

The Date Social Security Will Run Out Of Money Just Changed Money

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Understanding Delayed Retirement Credits Smartasset

Irs Data Retrieval Tool Finaid

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities