nh transfer tax calculator

NEW -- New Hampshire Real Estate Transfer Tax Calculator. The tax is assessed on both the buyer and seller upon the transfer sale or.

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

New Hampshire does not have a mortgage excise or recordation tax.

. Click Here to Search County Records. Atlanta Title Company LLC 1 404 445-5529 Residential and Commercial Real Estate Lawyers 945 East Paces Ferry Rd Resurgens Plaza Atlanta GA 30326 ATLANTA TITLE. The RETT is a tax on the sale granting and transfer of real property or an interest in real property.

One thing youll notice on your New Hampshire paycheck is deductions for FICA Federal Insurance Contributions Act taxes. Absolute Title LLC New Hampshire Fee Calculator Select A Different State. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev 800.

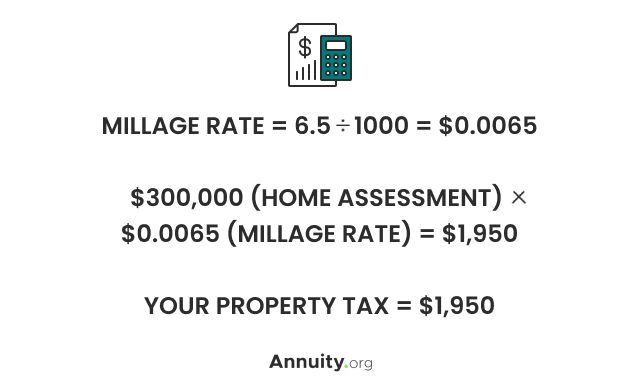

The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer. New hampshire salary tax calculator for the tax year 202122 you are able to use our new hampshire state tax calculator to calculate your total tax costs in the tax year 202122. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country.

2013 NH Tax Rates 2014 NH Tax Rates. New Hampshire Towns 2021 Real Estate Tax Ratios. This calculator is based upon the State of New Hampshires Department of Revenue.

Nh real estate transfer tax calculator. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767. Your average tax rate is.

Transfer Tax Endorsements Loan Premium Owners Premium Lender Premium Lender Premium Reissue Owner Premium. The amount of New Hampshire real estate transfer taxes is calculated by the contract price of the property and the tax rate of 750 per thousand. The calculation of the tax is often the task of the closing agent and is detailed.

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. Calculate Print. Senior Citizens selling primary residences blind or disabled persons and sellers of low or affordable income homes with resale controls or.

Delaware DE Transfer Tax. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer.

Does New Hampshire have a mortgage excise or recordation tax. View all NYC NYS Transfer Tax rates including the higher rate for commercial and 4-or-more family homes here. New Jersey Transfer Tax Rate Calculator.

For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. In those areas the state transfer tax rate would be 300. Social Security is taxed at 62 and Medicare at 145.

Sellers pay a combined NYC NYS Transfer Tax rate of 2075 for sale prices of 3 million or more 1825 for sale prices above 500k and below 3 million and 14 for sale prices of 500k or less. On average homeowners in New. New Hampshire Income Tax Calculator 2021.

Generally the seller will pay for the transfer tax in New York but if the seller is exempt then the responsibility to pay this tax falls upon the buyer. The Real Estate Transfer Tax RETT was enacted in 1967. The 2021 real estate tax rate for the town of stratham nh is 1852 per 1000 of your propertys assessed value.

See Recording Requirements NHRSA 78 B1 Transfer Tax. New Hampshire Department of Revenue Administration Governor Hugh Gallen State Office Park 109 Pleasant Street Medical Surgical Building Concord NH 603 230-5000 TDD Access Relay NH. NH Real Estate Transfer Tax Rate Table Purchase price rounded up to the next 100 x 015 Tax is rounded up to the next dollar amount 40 minimum tax for purchase less than 4000 Purchase Price.

Select Purchase or Refi 2. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. New York NY and NYC Transfer Tax.

The State of Delaware transfer tax rate is 250. Seller Transfer Tax Calculator for State of Georgia. The New York state transfer tax rate is 04 for homes below 3000000 and 065 for homes above 3000000.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. Strafford county is located in eastern new hampshire along the border with maine. Some areas do not have a county or local transfer tax rate.

Customarily the New Jersey Transfer Tax is paid by the seller and the Mansion Tax on residential or commercial purchases of 1 million or more is paid by the buyer. Select Property Type Residential Farm Property Regular Commercial Residential Cooperative Unit 4 families or less. Free Estate Size Worksheet.

New Hampshire Property Tax. It is levied as part of closing costs for both buyers and sellers and is usually required before the deed recorded. Who pays the transfer tax in New Hampshire.

It is sometimes referred to as nh tax. The real estate transfer tax in new hampshire is usually 15 of the fair market value of the property or the purchase price. The Tax Rates are the number of dollars assessed per 1000 of a propertys assessed.

14 Main Street 2nd Floor Newport NH 03773 Phone. The New Hampshire real estate transfer tax is 075 per 100 of the full price of or consideration for the real estate purchases. This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15.

From To transfer tax tax2 4001 4100 62 31 4101 4200 63 32 4201 4300 65 33 4301 4400 66 33 4401 4500 68 34 4501 4600 69 35 4601 4700. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Apply Senior Citizen Blind or Disabled Low Income Housing.

2021 new hampshire property tax rates. Monday Friday 800 AM 400 PM. FICA taxes are Social Security and Medicare taxes and they are withheld from each of your paychecks in order for you to pay into these systems.

Transfer Tax In San Diego County California Who Pays What

Sales Tax Calculator Credit Karma

What You Should Know About Contra Costa County Transfer Tax

Underwriters Processors Fha Real Estate Home Decor Home Buying First Time Home Buyers Buying A Ho Home Buying Buying Your First Home Home Buying Process

How To Calculate Sales Tax A Simple Guide Bench Accounting

Property Tax Calculator Casaplorer

Hawaii Sales Tax Calculator Reverse Sales Dremployee

A Breakdown Of Transfer Tax In Real Estate Upnest

Property Taxes Calculating State Differences How To Pay

Florida Property Tax H R Block

New Hampshire Income Tax Nh State Tax Calculator Community Tax

/images/2022/01/18/tax-time.jpg)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Dmv Fees By State Usa Manual Car Registration Calculator

How To Calculate Transfer Tax In Nh

Cryptocurrency Taxes What To Know For 2021 Money

Transfer Tax Alameda County California Who Pays What

Transfer Tax In San Luis Obispo County California Who Pays What

Should You Move To A State With No Income Tax Forbes Advisor